Overview

A new White Paper by the FTTH Council Market Intelligence Committee finds European FTTH deployment cost estimates are highly accurate. That makes investing in fibre highly attractive.

To determine whether the FTTH cost estimates used in European projects accurately represent the actual costs, the FTTH Council approached a wide selection of parties involved in fibre rollouts. The data was mainly provided by contractors but also operators and other stakeholders such as utilities, financial organisations, incumbents and consultants.

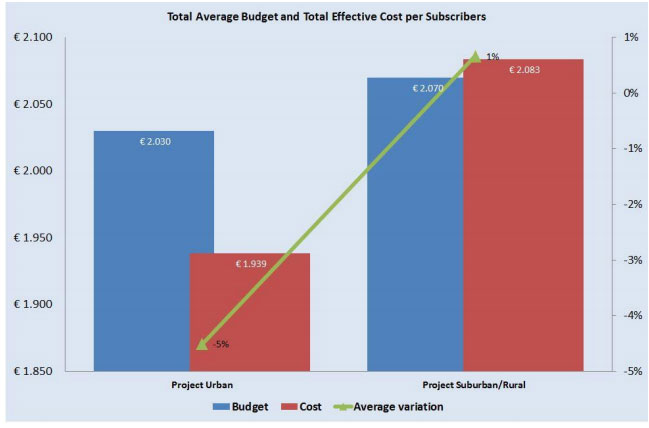

“This allowed us to assess the gaps between budgeted costs for deployment in various areas, and the actual spend,” explains Jan Schindler, Chair of the FTTH Council Europe Market and Intelligence Committee. “It turns out that cost estimates for fibre rollout projects across Europe are extremely accurate.

These costs are very stable, in urban as well as suburban and rural areas, despite minor fluctuations in the costs incurred for the last hundreds of metres. The differences between actual expenditure and budgets were generally very low, at less than 10%. This, in turn, makes it far easier to build accurate business cases and create attractive investment propositions.”

“The final few hundred metres is where the greatest surprises are found, both positive and negative, unrelated to the type of housing. This is largely related to the availability and reliability of infrastructure: ducts, poles, soil density…

What’s more, a percentage of homes will be uninhabited, so you simply can’t get access. A property may have been rebuilt in a way that makes access impossible. Maybe the fibre cable can only be laid in a place where it is

visible or unpractical and homeowners will refuse it for those reasons. Some properties with a very good 4G connection might not even be interested in fibre.”

Below budget

The study divided fibre deployments into two segments. The first was the infrastructure from the last active point (CO or S/C) to the branching point, which gives the calculation per HP (Home Passed). The second was the infrastructure from the branching point to the terminal outlet at the subscriber premises. Lower costs were sometimes encountered in ‘transport’ segments of the network between the Central Office and the first street cabinet. Subscriber connection costs, however, resulted in some negative surprises, but still the budget was not exceeded. Small additional costs incurred during the course of a deployment project are generally evened out by activities that go more smoothly than planned. Furthermore, estimates tend to be cautious, which means projects are more likely to be realised below budget.

Building the business case

“We also found that, whenever the real costs are lower than the budgeted costs, there is a tendency to spend the entire budget and thereby slightly enlarge the area to be covered. This, in turn, results in an increase the number of Homes Passed. Another interesting finding is the fact that different types of budgeting bodies come up with similar estimates. Areas in which gaps might occur are identical, regardless of the source of the costing. Independent consulting firms are just as reliable as the design offices of operators or integrators.»

In the past, potential investors, advisors and consultants have frequently voiced concerns about a lack of clarity when it comes to the cost of fibre rollouts. It appears that FTTH rollouts have left the ‘experimental’ phase and are now a highly standardised industrial process. They are becoming an accepted investment category without major risk. Today, operators, banks and other stakeholders in various countries consider fibre to be a reliable investment. This growing understanding and acceptance will accelerate rollout and opens up new possibilities in economically challenged areas that may become less dependent on government funding.

Source from FTTH Europe