Global GPON revenue declined 7 percent quarter-over-quarter to reach $1.32 billion. This decline was primarily associated with declining ASPs across all regions. Year-over-year, revenue increased by 32 percent. Asia Pacific continues to drive the majority of demand, where China is currently in the process of large scale FTTH deployments due to government mandated regulation.

OLT revenue declined by 17 percent in 1Q15 to reach $541 million, but increased by 16 percent from the same period in 2014. ONT unit revenue increased 2 percent from 4Q15 to reach $783 million, and increased 45 percent over 1Q14.

OLT revenue represented 41 percent of total GPON revenue in 1Q15.

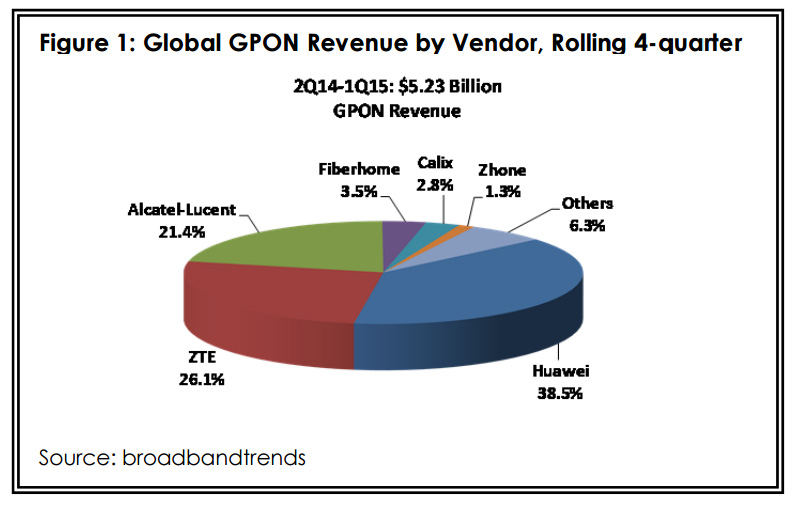

Huawei is the market leader for rolling 4- quarter GPON revenue with 39 percent market share, followed by ZTE with 26 percent and Alcatel-Lucent with 21 percent, as shown in Figure 1.

For 1Q15 revenue, Huawei leads with 40 percent, followed by ZTE at 26 percent and AlcatelLucent at 22 percent.

OLT ports shipments increased by 3 percent in 1Q15 to reach 1.23 million. On an annual basis, OLT port shipments grew 47 percent over 1Q14. ONT shipments (both Single Family and MultiDwelling) increased by 2 percent over 4Q14 to reach 13.7 million and grew by 51 percent over 1Q14. MxU ONTs represent approximately 4 percent of total ONT shipments in 1Q15.

- Global GPON Revenue decreased 7% from 4Q14 to reach $1.32 Billion in 1Q15

- Global OLT Port shipments increased 3% from 4Q14 to reach 1.23 million in 1Q15

- Global ONT unit shipments increased by 2% from 4Q14 to reach 13.7 million units in 1Q15

- Huawei is the global market leader for both rolling 4-quarter and current quarter market share

- 85% of all OLT Ports and 83% of all ONTs units were shipped into Asia Pacific during 1Q15